X-Order2018-12-21

In the past year, cryptocurrency market has grown exponentially. The scale and speed of its expansion has baffled people’s mind. Many question the inherent value of cryptocurrency, the question of whether cryptocurrency is a new kind of bubble or a new Ponzi scheme has crossed and hooked everyone’s mind save those few most ardent crusaders of cryptocurrency. It is not surprising then to see people from all backgrounds and working in the entire stratosphere of our economy show their eager curiosity about cryptocurrency by asking what exactly does cryptocurrency mean to our present day society?

In order to answer this question, we need to understand the nature of the financial market, and how the market defines value. Let us begin this journey of discovery by first going down to the basics by rigorously examining the expansionary structures of financial assets.

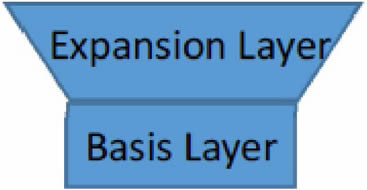

When we attempt to comprehend the structure of capital expansion, we have to first employ the concept of a basis layer, which represents our inherent value orientation. This layer corresponds directly to our most basic human needs, such as to feel secure and to survive. For instance, this capital layer corresponds directly but is not limited to our need for food, clothes for warmth, and a safe place to live out our lives. On top of this is the expansion layer, which is the new capital expansion model we aspire to construct. From our perspective, the most basic capital expansion structure can be separated into two layers: the basis layer and the expansion layer.

This is our original value floor, which is also the basis of confidence for our designers, operators and users. We will use this as the foundation in our attempt to build a new capital expansion model. If the top expansion layer requires restructuring or correction, we will always be able to come back to the basis layer through redemption.

This is the heart of the new expansionary model we aim to build. In comparison to the basis layer, the expansion layer is able to adapt to a broader range of scenario and provide more liquidity. In order to satisfy these properties, the expansion layer will inevitable include more elements. However, the effects of these elements are still hypothetical and lacking empirical evidence and testing.

Due to the lack of empirical validation, people lack consistent confidence in the construction of the expansion layer. In the meantime, expansion layer attempts to support a broader range of circumstances. Combining these two handicaps, there will be an inevitable movement of the mass from the expansion layer to the basis layer when significant negative changes happen in the expansion layer. This phenomenon is known as a run. This also means that the increased liquidity provided by the expansion layer will create bottleneck as the flow from the expansion layer to the basis layer reaches a certain level that is above the liquidity threshold of the basis layer, causing congestion and a scenario not all redemption actions can be completed.

When the expansion layer attains a sufficient and sustainable level of stability, people will have enough confidence of the expansion layer to allow the expansion layer to break free from the liquidity bottleneck of the original basis layer. When the expansion layer becomes independent, it will start to accumulate capital. We call this process a decoupling experiment. When the expanding layer announced to the external world that it is no longer going to provide complete redemption for the basis layer, a decoupling experiment will take place. As the decoupling experiment takes place, the expansion layer has then truly transformed its role from been subsidized to subsisting. The success of the decoupling experiment depends upon the size of demand for the scenario that is created by the expanding layer. Whether or not the expansion layer can become mainstream finance is determined by the success of the decoupling experiment.